2022-2-8The tax reference types SG OG D and C are the most often seen. May not be combined with other offers.

Publishing On Amazon Other Important Matters Teaspoon Publishing

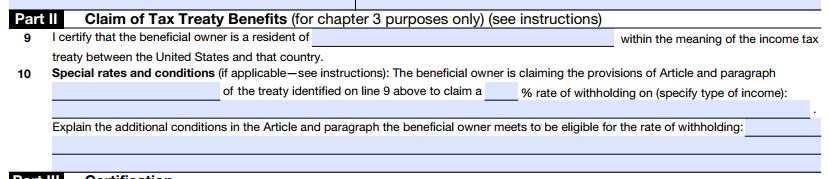

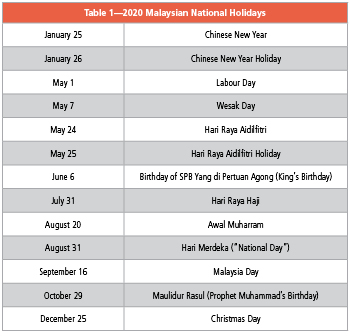

2020-4-23The gross amount of interest royalty and special income paid by the payer to a NR payee are subject to the respective withholding tax rates of 15 10 and 10 or any other rate as prescribed under the Double Taxation Agreement between Malaysia and the country where the NR payee is a tax resident.

. Tool requires no monthly subscription. When we collect. Drag-n-drop only no coding.

Find many great new used options and get the best deals for 2020 Upper Deck Series 2 456 TY SMITH RC YOUNG GUNS ROOKIE CARD PSA 10 GEM MINT at the best online prices at eBay. Engine as all of the big players - But without the insane monthly fees and word limits. Find Out Which Taxable Income Band You Are In.

We wont stop until all business is a force for good. The 147 kg heroin seizure in the Odesa port on 17 March 2015 and the seizure of 500 kg of heroin from Turkey at Illichivsk port from on 5 June 2015 confirms that Ukraine is a channel for largescale heroin trafficking from Afghanistan to Western Europe. Formally a string is a finite ordered sequence of characters such as letters digits or spaces.

There are many types of business entities defined in the legal systems of various countries. The empty string is the special case where the sequence has length zero so there are no symbols in the string. Malaysias semiconductor industry which takes up 13 per cent of global chip assembly and testing market share is set to benefit from the United States CHIPS and Science Act.

2022-10-17Employment income - Gross income from employment includes wages salary remuneration leave pay fees commissions bonuses gratuities perquisites or allowances in money or otherwise arising from employment. Overpaid Taxes Can Be Refunded In The Form Of A Tax Return. This is important because the Malays who support PH need to know whether the Malay leaders supported by PH are useful or useless.

2022-3-8Income tax Malaysia starting from Year of Assessment 2004 tax filed in 2005 income derived from outside Malaysia and received in Malaysia by a resident individual is exempted from tax. Find Out Which Taxable Income Band You Are In. A map of the British.

An individual employed in Malaysia is subject to tax on income arising from Malaysia regardless of where the employment contract is signed or. Not all countries impose a capital gains tax and most have different rates of taxation for individuals versus corporations. WHO works with governments and partners across the Region to promote health keep the world safe and serve the vulnerable.

2022-9-19So what type of Malays are acceptable to DAP. 2022-3-14These Are The Personal Tax Reliefs You Can Claim In Malaysia. Your income tax identification number is made up of a tax reference type that is either a one- or two-letter code followed by a ten- or eleven-digit tax reference number.

Most often business entities are formed to sell a product or a service. The risk of drug smuggling across the Moldova-Ukraine border is present along all segments of the border. Start creating amazing mobile-ready and uber-fast websites.

Or are they merely stooges of DAP Zaid asked adding that voters would need to know the characteristics of Malay leaders which meet the opposition party. Then everyone living in the now-claimed territory became a part of an English colony. 2022-10-12B Lab is a global nonprofit network transforming the global economy to benefit all people communities and the planet.

How Does Monthly Tax Deduction Work In Malaysia. To qualify tax return must be paid for and filed during this period. 2022-3-8These Are The Personal Tax Reliefs You Can Claim In Malaysia.

A month later in his Budget 2022 speech the finance minister revealed proposals aimed at developing a sustainable economy including the launch of the. Free shipping for many products. Free for any use.

How Does Monthly Tax Deduction Work In Malaysia. 2022-10-17A capital gains tax CGT is the tax on profits realized on the sale of a non-inventory assetThe most common capital gains are realized from the sale of stocks bonds precious metals real estate and property. 2022-10-18Get the latest international news and world events from Asia Europe the Middle East and more.

2022-10-11A business entity is an entity that is formed and administered as per corporate law in order to engage in business activities charitable work or other activities allowable. You will be granted a rebate of RM400. 2022-6-27Outlook puts you in control of your privacy.

2021-3-25The deadline for filing income tax in Malaysia also varies according to what type of form you are filing. We dont use your email calendar or other personal content to target ads to you. 2019-9-30The British men in the business of colonizing the North American continent were so sure they owned whatever land they land on yes thats from Pocahontas they established new colonies by simply drawing lines on a map.

For example if you take up a job while overseas and you only receive the payment for the job when you are back in Malaysia. For the BE form resident individuals who do not carry on business the deadline for filing income tax in Malaysia is 30 April 2021 for manual filing and 15 May 2021 via e-Filing. Offer period March 1 25 2018 at participating offices only.

Content Writer 247 Our private AI. Heres How A Tax Rebate Can Help You Reduce Your Tax Further. 2 days agoThe Western Pacific Region is home to almost 19 billion people across 37 countries and areas in the Asia Pacific.

Tax rebate for Self. 2022-1-1We are committed to be a carbon-neutral country at the earliest in 2050 This was the welcome statement by Prime Minister Datuk Seri Ismail Sabri Yaakob during the tabling of the 12th Malaysia Plan 2021-2025. As an illustration SG 12345678901.

We help you take charge with easy-to-use tools and clear choices. Were transparent about data collection and use so you can make informed decisions. Over 500000 Words Free.

Meanwhile for the B form resident individuals who carry. Heres How A Tax Rebate Can Help You Reduce Your Tax Further. Overpaid Taxes Can Be Refunded In The Form Of A Tax Return.

2022-1-5A tax rebate reduces the amount of tax charged there are currently four types of tax rebates for income tax Malaysia YA 2021. If your chargeable income does not exceed RM 35000 after the tax reliefs and deductions. This tax rebate is why most Malaysia n fresh.

Valid receipt for 2016 tax preparation fees from a tax preparer other than HR Block must be presented prior to completion of initial tax office interview.

Japan Tobacco Tax Revenue Distribution By Type Statista

.jpg)

Lifestyle Tax Relief 2021 Malaysia Malaysia Income Tax 2022 A Guide To The Tax Reliefs You Can Claim For Ya 2021

What You Need To Know About Malaysias Tax System

:max_bytes(150000):strip_icc()/FormW-8EXP-3371d5b787624c43ba4680877d229add.jpeg)

W 8ben When To Use It And Other Types Of W 8 Tax Forms

Policy Basics Where Do Federal Tax Revenues Come From Center On Budget And Policy Priorities

Income Tax Submission Yy Chong Co

International U S Energy Information Administration Eia

Overview Of Tax System In Malaysia Gelifesavers

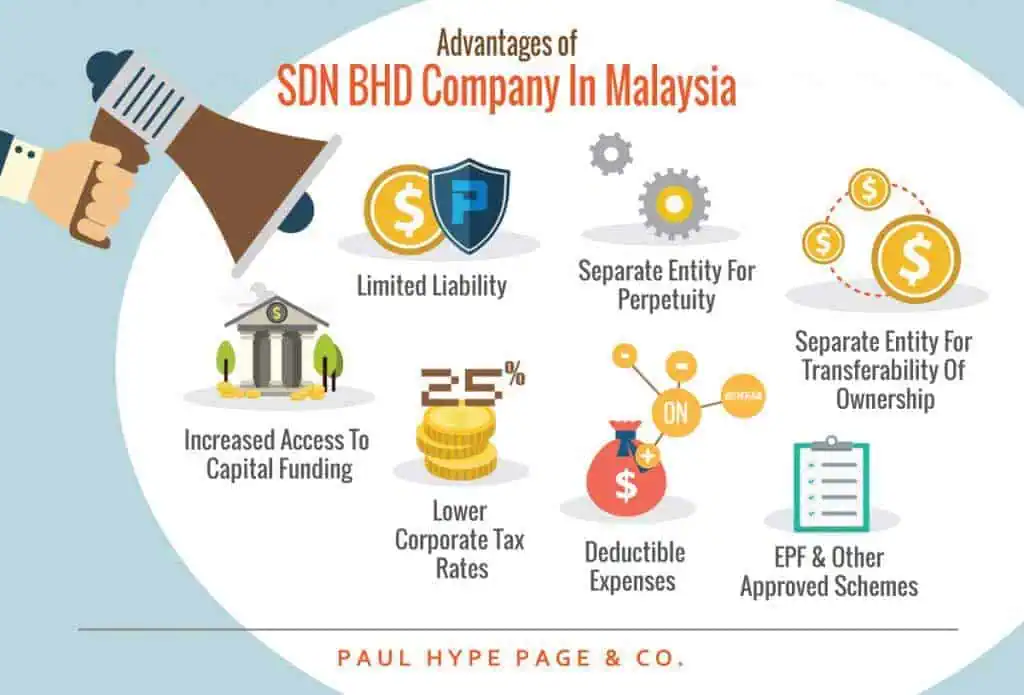

Corporate Tax Malaysia 2020 For Smes Comprehensive Guide Biztory Cloud Accounting

Malaysia Personal Income Tax Guide 2020 Ya 2019

The Tax System In Malaysia Guide Expat Com

Malaysia Personal Income Tax Guide 2020 Ya 2019

Thewall Profited From Trading Bitcoin Find Out If You Need To Pay Taxes The Edge Markets

How Does The Current System Of International Taxation Work Tax Policy Center

Penjana Special Tax Incentive Cheng Co Group

Rental Income Tax Malaysia And Other Tax Reliefs For Ya 2021